We would like to remind you that the payment deadline for the 1st provisional tax installment for tax year 2023 is 31 December 2023.

Obligation for provisional tax payment

The following persons have an obligation to pay provisional tax, based on their expected annual taxable income for tax year 2023:

- Individuals with taxable income other than salaries, pensions, dividends and interest; and

- companies with taxable income.

Persons with no taxable income, do not have an obligation to pay provisional tax.

Payment of provisional tax

The provisional tax is calculated by applying the relevant tax rates (depending on whether the taxpayer is an individual or a company) on the expected taxable income for the year, after taking into account any overseas tax credits. It is payable in two equal instalments, as follows:

| Provisional tax instalments | Statutory deadline | Effective deadline (No interest/penalty) |

| 1st instalment | 31 July 2023 | 31 August 2023 |

| 2nd instalment | 31 December 2023 | 31 January 2024 |

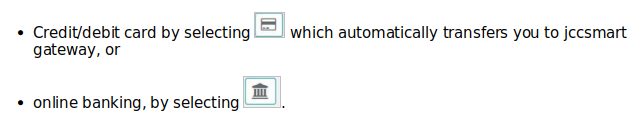

The timely payment of provisional tax can be made by firstly creating the provisional tax obligation through the Tax Portal of the Tax Department (TD) and then selecting one of the below payment methods from the icons appearing next to the Payment Reference Number (PRN):

Payments made after the effective deadline can only be made via online banking and will be subject to interest at the current rate of 2,25% per annum (calculated on a completed months basis) plus a 5% penalty on the tax due. An additional penalty of 5% may be imposed by the TD if the tax remains unpaid two months after the statutory deadline (i.e. for the 1st instalment, the penalty will be imposed from 1 October onwards).

Any difference between the actual tax payable and the temporary tax paid for the year 2023 is payable by 1st of August 2024.

10% additional tax in case of underestimation

In case the provisional taxable income declared is less than 75% of the final taxable income for the year, the taxpayer is required to pay an additional tax equal to 10% of the difference between the final tax due and the provisional tax paid.

Revised provisional tax calculation

Taxpayers can revise their provisional tax calculation (upwards/downwards) until 31 December 2023. In case of an upward revision, interest is payable on the difference between the revised amount payable and the amount initially declared and paid as 1st instalment. It is noted that for downward revisions, Forms TD.5 (for individuals) and TD.6 (for companies) should be submitted.